Key Intake

Q1: What fees do MyFastBroker business brokers charge?

Usually 5–7% net cost, lower than industry average. Always confirm in writing.

Q2: How can I sell a business confidentially?

The platform uses NDAs and confidential listings, but verifies broker protocols too.

Q3: Why use a broker instead of selling directly?

Brokered deals close faster (70–80% success) vs. DIY sales (25–30%).

Q4: Which businesses are easiest to sell quickly?

E-commerce shops, SaaS firms, and food franchises often 2–4 months if priced right.

Table of Contents

Quick Answer

MyFastBroker business brokers use AI-driven matching to connect sellers and buyers with vetted professionals, reducing average sale times to 3–5 months while offering lower, transparent fees than traditional brokers. In short, it’s a faster, tech-Usually 5–7% net cost, lower than industry average. Always confirm in writing.enabled alternative to old-school brokerage.

Unlock More Insights

Introduction

Selling or buying a business today feels overwhelming too many brokers, unclear fees, and long timelines. That’s exactly why MyFastBroker business brokers are drawing attention in 2025. According to IBBA, the average small business sale still takes 6-9 months and costs 8-12% in commissions. By contrast, user-reported data from MyFastBroker shows average closings in 3-5 months with lower, more transparent fees. Add in algorithmic broker-matching, and it’s clear why entrepreneurs are looking here first.

What is MyFastBroker.com and how does it work for business sales?

MyFastBroker.com works as a digital broker marketplace. Sellers and buyers enter details (industry, size, location, goals), and the platform recommends licensed brokers through an AI algorithm. Think of it like a broker “matchmaker” instead of a traditional broker who controls the deal.

- Not a trading site: Important distinction, MyFastBroker’s brokerage service is separate from its financial trading division.

- Comparison dashboard: Users see side-by-side broker fees, specialties, and success rates before committing.

How much does MyFastBroker charge for business brokerage services?

Most sellers worry about hidden fees. Traditional brokers usually charge 8–12% commissions (BizBuySell data). By contrast, MyFastBroker business brokers typically work on referral fees paid by brokers, not direct commissions from users.

- Sellers often report net costs closer to 5–7%.

- Fee details vary by broker, so always request full agreements in writing.

Takeaway: MyFastBroker reduces upfront cost pressure compared to traditional brokers, but you still need diligence on the fine print.

What are the pros and cons of using MyFastBroker versus traditional brokers?

MyFastBroker emphasizes speed, choice, and tech transparency, but lacks the direct accountability of traditional licensed brokers.

| Feature | Traditional Brokers | MyFastBroker |

| Commission | 8–12% | 5–7% avg. reported |

| Broker Choice | Manual search | AI-driven matching |

| Oversight | Direct licensing | Operates as referral platform |

| Avg Timeline | 6–9 months | 3–5 months |

Pros: Transparent broker comparisons, faster average deals, cost savings.

Cons: Platform doesn’t conduct sales directly; users must vet broker credentials themselves.

How long does it take to sell a business through MyFastBroker?

User reports show MyFastBroker sales close in 3–5 months, faster than the 6–9 month industry average.

This efficiency comes from:

- AI valuations with instant pricing ranges.

- Verified buyer pools that reduce wasted time.

- Digital negotiation tools streamlining back-and-forth.

For context, DIY sellers (no broker) often face 12+ months with only 25–30% success rates. That’s where the platform saves time.

Is MyFastBroker legitimate and safe for business transactions?

Yes, but with caveats. MyFastBroker itself is a matching platform, not a licensed broker. It connects you to vetted professionals, but you must still verify licenses and hire your own lawyer/accountant.

- Platform uses data encryption and NDAs to protect listings.

- Funds are never held by MyFastBroker transactions run through brokers.

Safety Checklist:

- Verify broker’s license number.

- Ask for written agreements.

- Confirm escrow arrangements separately.

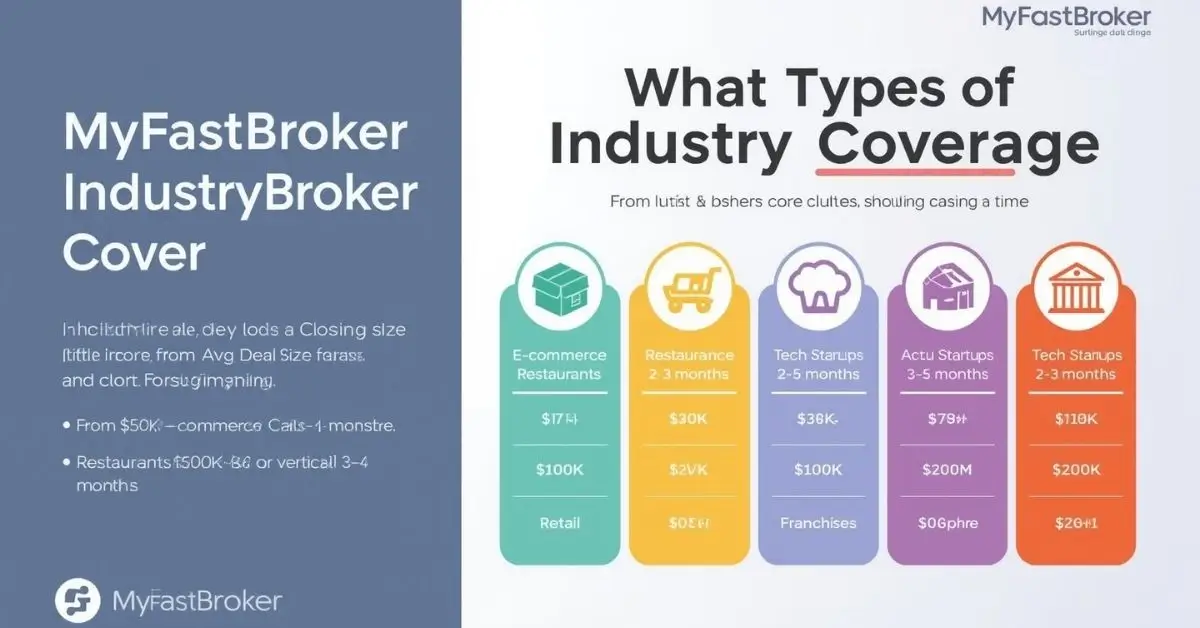

What types of businesses and industries does MyFastBroker cover?

The platform matches brokers for retail, e-commerce, restaurants, tech startups, manufacturing, and franchises. Reported deal ranges span from $50k e-commerce stores to $20M tech companies.

| Industry | Avg Deal Size | Avg Closing Time |

| Retail | $150k–$600k | 4–6 months |

| E-commerce | $80k–$1.5M | 2–3 months |

| Restaurants | $120k–$800k | 3–5 months |

| Tech Startups | $300k–$20M | 4–6 months |

| Franchises | $200k–$2M+ | 3–4 months |

How do I choose between MyFastBroker and traditional business brokers?

Choose MyFastBroker if you want speed and cost efficiency; pick traditional brokers if you need localized expertise.

Decision Framework:

- Use MyFastBroker → standardized businesses, cost-sensitive deals, or when you want comparison visibility.

- Use Traditional Broker → niche industries, complex valuations, or deals over $10M needing hands-on guidance.

Hybrid Strategy: Some sellers start on MyFastBroker to compare brokers, then finalize with a local broker for extra security.

Sources

- Yahoo Finance: U.S. Business Brokers Industry Research Report 2024–2030 (market trends and growth insights)

- LinkedIn: Business Broker Service Market Report 2025–2033 (competitive landscape and forecasts)

- London Business Mag: MyFastBroker.com: The Go-To Guide for Modern Traders

- TechX: MyFastBroker.com Review: Speed, Tools & Security

- Kahan Chale: MyFastBroker.com: Smart Broker Matching & Trading Guide

Conclusion

MyFastBroker offers faster sales, lower fees, and transparent broker choices, ideal for small business owners and buyers. While complex, high-value deals may still need a traditional broker’s touch, most users benefit from MyFastBroker’s speed and clarity.Bottom line: It’s a modern brokerage platform built for 2025, giving entrepreneurs and investors a smarter path to closing deals.

Author Bio

Daniel R. Hayes is a Business Transaction Advisor with 12+ years helping entrepreneurs buy and sell businesses across industries.

→If you are more in to this topic, We highly recommend watching!